401k minimum distribution calculator

Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year.

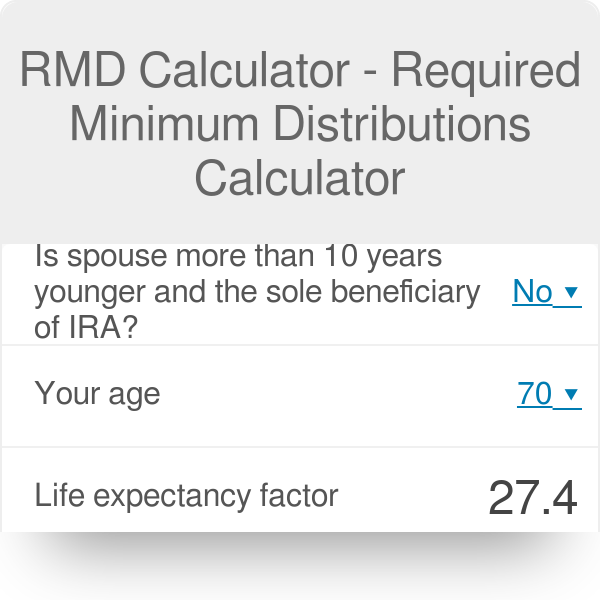

Rmd Calculator Required Minimum Distributions Calculator

Ad Learn More About American Funds Objective-Based Approach to Investing.

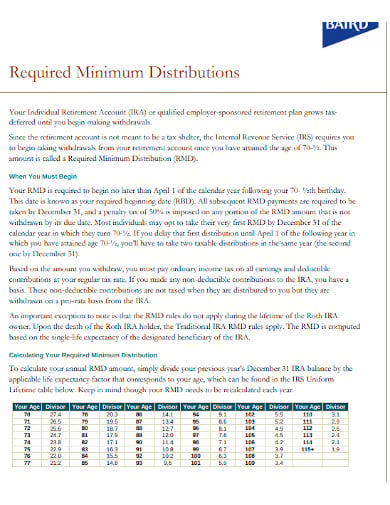

. An RMD is the minimum amount of money you must withdraw from a tax-deferred retirement plan and pay ordinary income. Find out when you should withdraw from your retirement savings and. If you do not take your RMD youll.

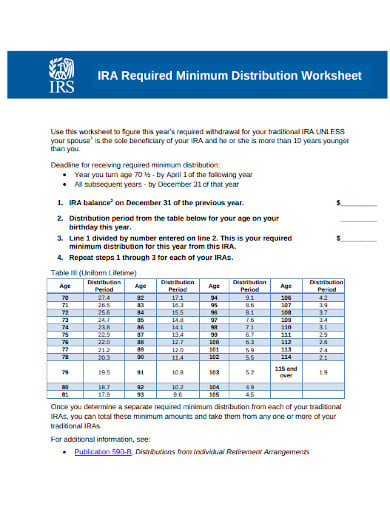

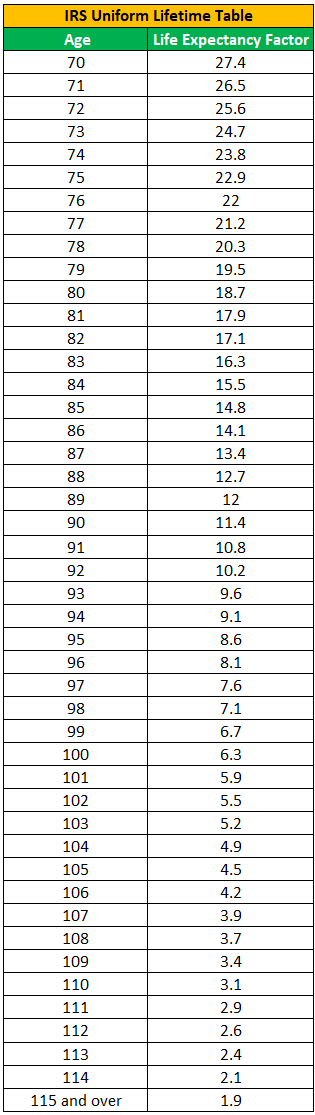

Use IRS Publication 590-B to calculate your 401k RMDs it includes life expectancy tables that correspond to your specific. Ad Use This Calculator to Determine Your Required Minimum Distribution. If you dont take your mandatory 401k distribution payments however you can lose some of your money.

Account balance as of December 31 2021 7000000 Life expectancy factor. Your Required Minimum Distribution this year is 0 How is my RMD calculated. Open a Roth IRA Account.

Do 401Ks Have Required Minimum Distribution. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from.

Use this calculator to determine your Required Minimum Distribution RMD. Updated for 2022 Use our required minimum distribution. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules.

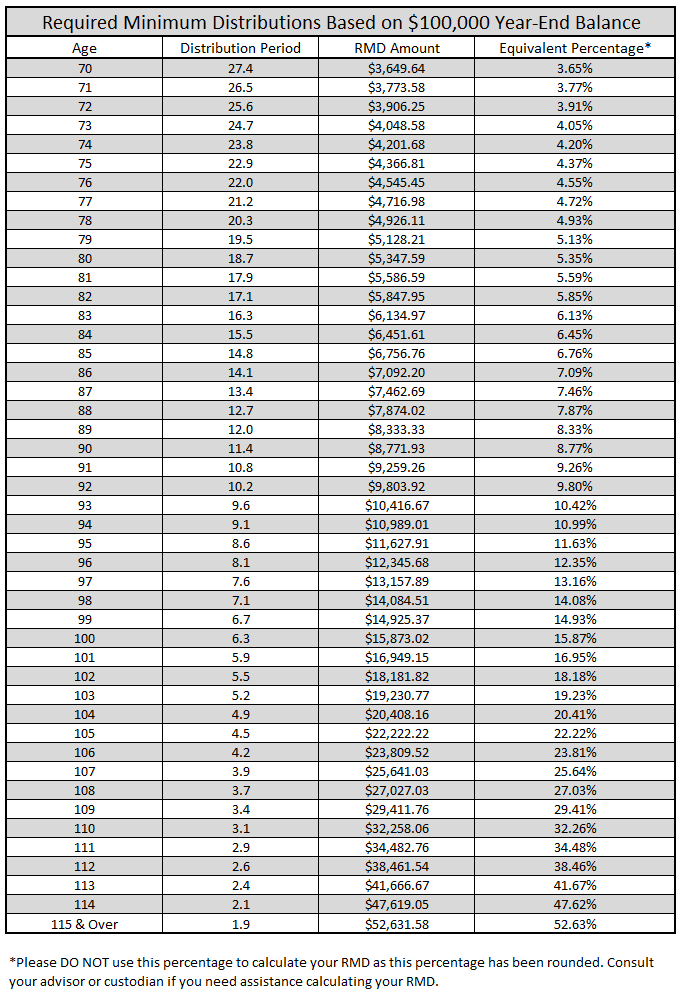

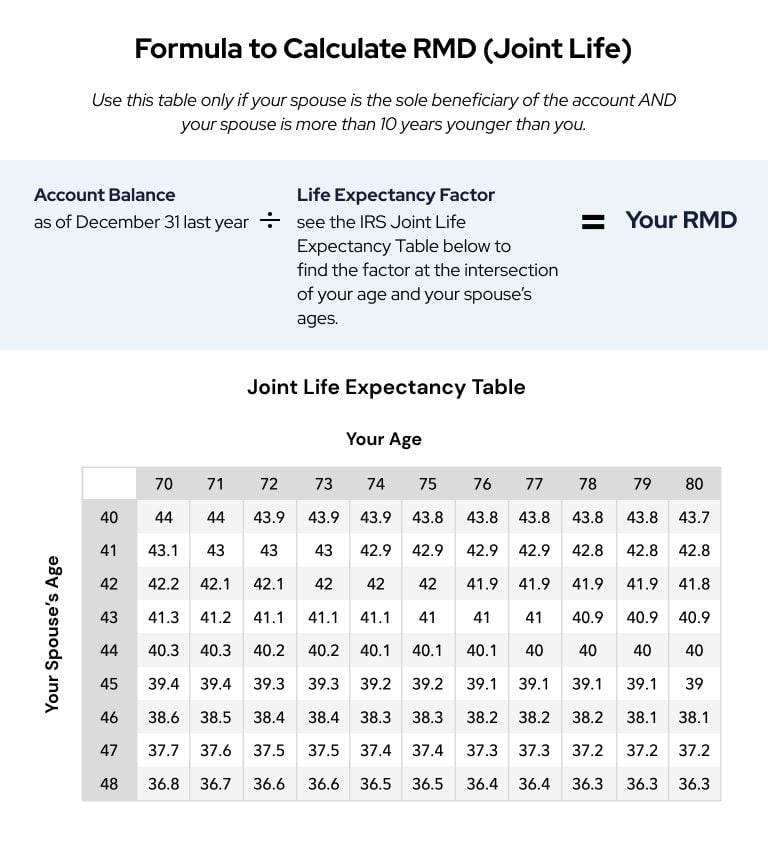

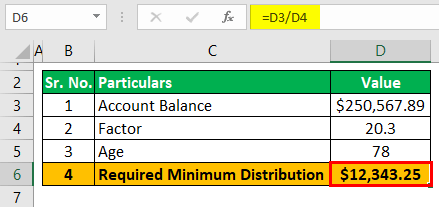

We also offer a calculator for 2019 RMD. How is my RMD calculated. Calculating the required minimum distribution The required minimum distribution for any year is the account balance as of the end of the immediately preceding calendar year.

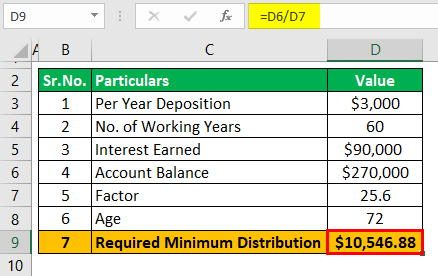

This calculator as discussed can be used for calculating the required minimum distribution amount per rules and regulations determined by the authorities for the IRA IRA 401k is a. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. Ad The Sooner You Invest the More Opportunity Your Money Has To Grow.

Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. This 401k distribution calculator is very simple and all it asks is that you enter your account balance at the end of the last year. The RMD rules apply to all employer sponsored retirement plans including profit-sharing plans 401 k plans 403 b plans and 457 b plans.

The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. As an example we will enter 100000 as the account.

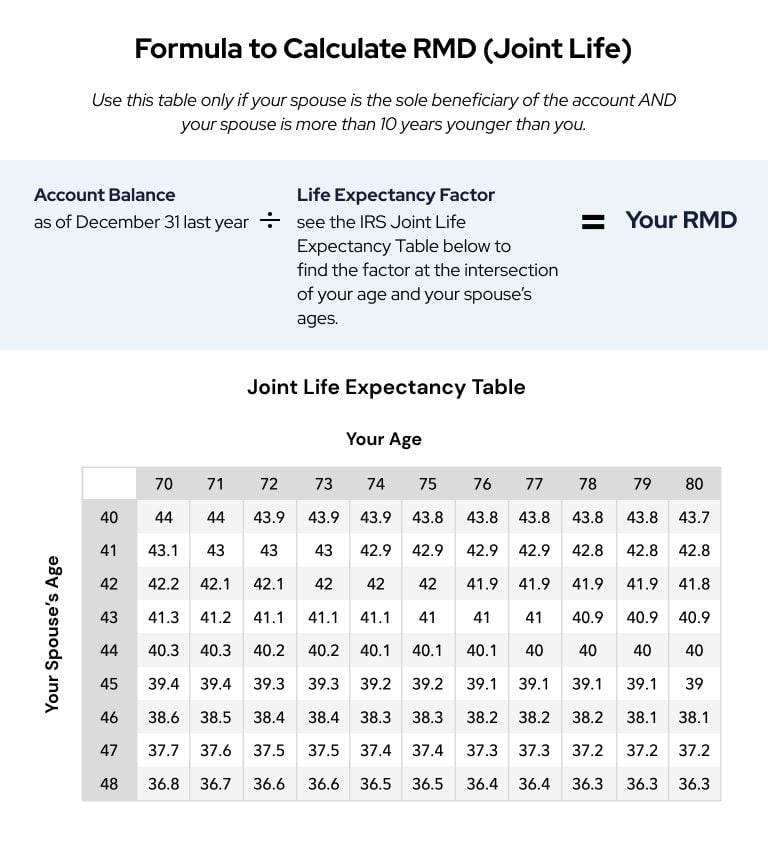

Find your age on the table and. If you are the original account owner your RMD is calculated by dividing prior year-end account balances by a life expectancy factor in the IRS Uniform Lifetime Table PDF. See How American Funds Can Help Improve Client Outcomes Through Objective-Based Investing.

And from then on. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. The amount of your RMD is based on your account balance and life expectancy.

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. This calculator helps people figure out their required minimum distribution RMD to help them in their retirement planning.

The IRS provides worksheets and tables to calculate RMDs. Dont Pay Taxes When You Withdraw Your Money After You Retire. Ad Build Your Future With A Firm That Has 85 Years Of Investing Experience.

What Is a Required Minimum Distribution RMD. Our free 401k Distribution Calculator helps you to determine your withdrawal amount and where you stand with your 401k or IRA account. Ad Build Your Future With A Firm That Has 85 Years Of Investing Experience.

If you were born on or after. The RMD rules also apply to. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules.

Ad Use This Calculator to Determine Your Required Minimum Distribution. Starting the year you turn age 70-12. The SECURE Act of 2019 changed the age that RMDs must begin.

Knowledge Base Required Minimum Distributions Rmd S Help Center Financial Planning Software Rightcapital

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

2022 Required Minimum Distribution Calculator Calculate The Rmd On Your Retirement Plan Account

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

Retirement Withdrawal Calculator For Excel

What Is The Required Minimum Distribution From Retirement Accounts The Heritage Law Center Llc

Ira Growth And Distribution Calculator Retirement Planning Tool

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Rmd Table Rules Requirements By Account Type

An Easy To Understand Guide To Required Minimum Distributions Retirement Field Guide

Rmd Table Rules Requirements By Account Type

Required Minimum Distribution Calculator Estimate Minimum Amount

Required Minimum Distribution Calculator Estimate Minimum Amount

Ira Withdrawal Calculator Factory Sale 52 Off Rikk Hi Is

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Required Minimum Distribution Calculator Estimate Minimum Amount